How Business Intelligence Dashboards Reduce Reporting Time for Financial Service Companies

Learn how business intelligence dashboards enable financial service companies to save time, reduce manual errors, and streamline compliance reporting with real-time insights.

BUSINESS INTELLIGENCEBUSINESS APPLICATIONS

Key Points

Financial service companies handle large, complex data from transactions, compliance, and risk systems, making manual reporting slow and error-prone.

Traditional reporting methods rely on spreadsheets and multiple systems, causing delays, mistakes, and increased compliance risks.

BI dashboards automate data integration, consolidate information, and provide real-time updates for faster, more accurate reporting.

Dashboards improve compliance by standardizing formats, creating audit trails, and maintaining version control.

Key benefits include cycle time reduction (50–70%), improved accuracy, enhanced collaboration, and faster decision-making.

ROI from BI dashboards is significant, with studies showing an average 130% return within three years due to labor savings and quicker regulatory responses.

Actionable takeaway: Implement a BI dashboard solution to centralize financial data, automate reporting, and enable real-time insights for faster, compliant, and data-driven decisions.

Introduction

Financial service companies handle enormous volumes of data every day. From transactions and compliance checks to customer reporting and risk analysis, the information is vast and complex. Traditional reporting methods, often reliant on spreadsheets and manual processes, can take days or even weeks to complete. This not only drains resources but also slows down decision-making.

Business Intelligence (BI) dashboards offer a solution. By automating reporting and centralizing data, they reduce reporting time, improve accuracy, and support smarter, faster decisions. This article explores how BI dashboards transform reporting for financial service companies.

Why is reporting so time-consuming in financial services?

Financial services are heavily data-driven. Yet reporting is often a struggle because of the following challenges:

Manual data consolidation: Teams rely on spreadsheets and manually pulling data from different systems.

Multiple data sources: Financial data comes from transactions, compliance systems, CRM platforms, and risk models. Merging this data manually is slow.

Regulatory demands: Compliance requires precise reporting formats and details, which add extra steps.

High risk of errors: Manual processes lead to mistakes that trigger time-consuming reviews.

What are the risks of slow reporting?

Missed opportunities for timely market decisions.

Higher compliance risks due to reporting delays.

Loss of competitiveness compared to firms with faster insights.

A McKinsey report highlights that slow reporting cycles often create blind spots for financial institutions, exposing them to unnecessary risk.

How do Business Intelligence dashboards reduce reporting time?

BI dashboards are designed to solve the inefficiencies of traditional reporting. They:

Automate data integration: Dashboards connect to multiple systems and automatically consolidate data.

Provide real-time updates: Instead of waiting for manual refresh, leaders can see the latest figures instantly.

Offer pre-built templates: Common financial KPIs and compliance metrics are built into many dashboards, reducing setup time.

Enable central access: Dashboards are cloud-based, so different teams can view the same data simultaneously.

Can dashboards improve compliance reporting too?

Yes. Dashboards support compliance by:

Standardizing formats for regulatory submissions.

Creating automated audit trails.

Maintaining version control to ensure accuracy.

According to Gartner, organizations using BI platforms see a significant reduction in manual reporting efforts, freeing compliance teams to focus on higher-value tasks.

What impact do dashboards have on financial service companies?

The impact of BI dashboards is measurable and substantial:

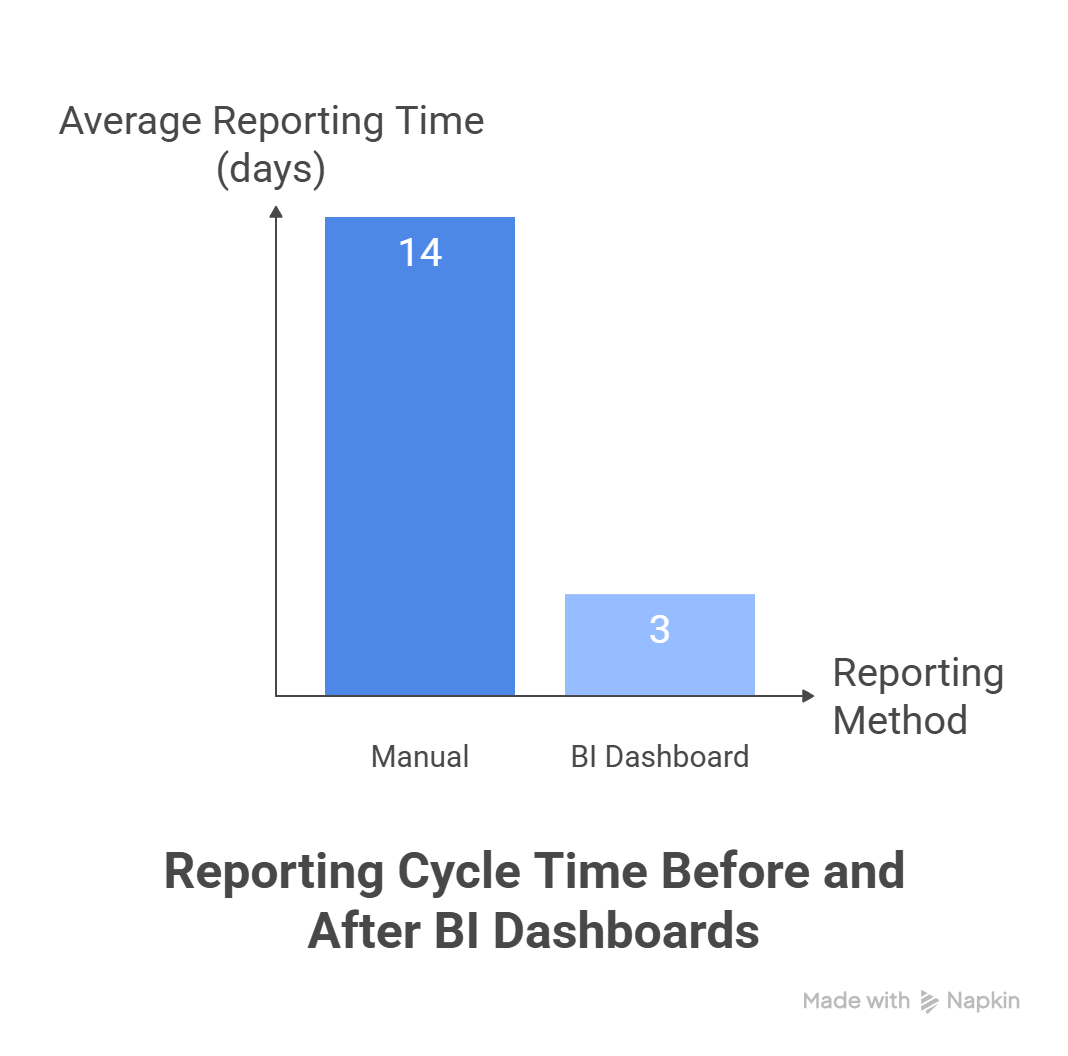

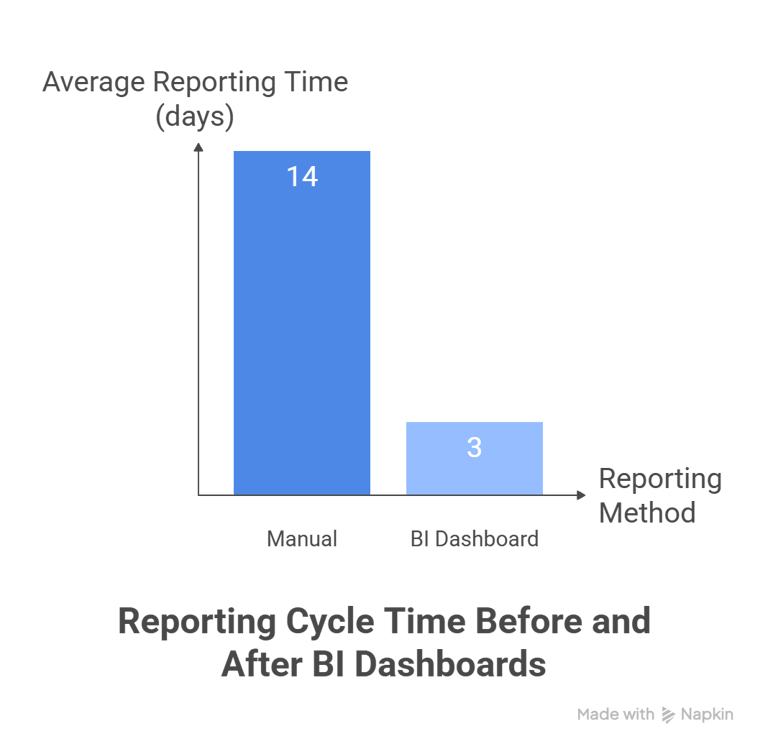

Cycle time reduction: Companies often report cutting reporting time by 50–70%, moving from weeks to days or hours.

Improved accuracy: Less manual handling means fewer errors.

Enhanced collaboration: Finance, risk, and operations teams can work from the same data source.

Faster decisions: Leaders no longer wait for delayed reports to act.

Are there measurable ROI benchmarks?

A Deloitte study shows that financial institutions using BI and analytics platforms achieve an average ROI of 130% within three years.

Savings often come from reduced labor hours spent on reporting.

Companies can respond faster to regulatory changes, reducing penalties and compliance costs.

How Exology Helps

Exology specializes in creating BI dashboards tailored for financial service companies. Here’s how we support clients:

Automate data consolidation across banking, insurance, and investment platforms.

Build custom dashboards aligned with financial KPIs and compliance needs.

Provide audit-ready reporting tools with full accuracy and transparency.

Enable executives to access real-time insights for faster decision-making.

Offer Business Intelligence as a Service (BIAAS) for continuous updates and optimization.

to see how Exology dashboards can simplify your reporting process.

Conclusion

Reporting has long been a pain point for financial service companies. Slow, manual processes make it difficult to keep up with the pace of today’s markets and regulations. Business Intelligence dashboards offer a practical solution, transforming reporting into a faster, more accurate, and more strategic function. By adopting BI dashboards, financial companies can save time, reduce risk, and empower leaders with the insights they need to stay competitive.

Read More

Contact us

Whether you have a request, a query, or want to work with us, use the form below to get in touch with our team.